Our comprehensive risk management system provides you with the necessary tools to identify, control and mitigate every risk categorized under multiple heads and dimensions. By leveraging our solution, you can ensure the security and safety of your business, safeguarding your processes and valuable assets.

With Arukus Enterprise Risk Management, you can save valuable time and money by proactively addressing risks that could potentially disrupt your business. Safeguard your processes, protect your assets, and gain a competitive edge by implementing a comprehensive risk management solution tailored to your organization's needs

Arukus Enterprise Risk Management platform employs a dynamic risk scoring mechanism where the movement of an individual risk score is monitored based on updates in the KRI values, while mitigation and control measures are underway.

As KRIs and Risk Impact on organization processes continue to evolve, so too will the Risk Score, allowing risks to shift between higher and lower scores, creating a dynamic landscape of proactive risk management.

Organizations can have both birds eye and detailed view of the Risk Landscape across departments, processes and identify top risks, risk trends and make informed decisions.

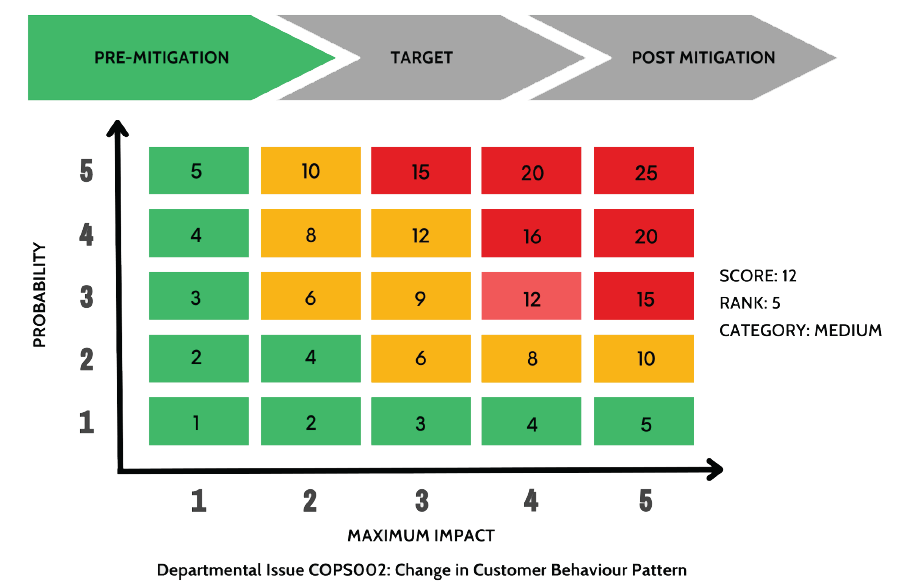

At the heart of our system lies the comprehensive evaluation of every risk, meticulously quantified by its Probability and Impact Value within the dynamic realm of our 'Risk Measurement' Stage. By multiplying the Probability with the Maximum Impact value, we derive the Risk Score - a powerful indicator that ranges from 1 to 25, encapsulating the entire spectrum of potential outcomes.

Updating the Probability is as simple as maintaining a single Key Risk Index (KRI), while Impact adjustments are handled by the designated Risk Owner. This fluid process ensures that any change to either Probability or Max Impact triggers an immediate recalculation of the Risk Score.

With Arukus Enterprise Risk Management, you can save valuable time and money by proactively addressing risks that could potentially disrupt your business. Safeguard your processes, protect your assets, and gain a competitive edge by implementing a comprehensive risk management solution tailored to your organization's needs

But that's not all - our solution takes it a step further by generating Risk Ranks of all branches based on the Risk Scoring System. Higher scores equate to lower ranks. As Key Risk Indicators (KRIs) and Impact continue to evolve, so too will the Risk Score, allowing risks to shift between higher and lower scores, creating a dynamic landscape of proactive risk management.

Empowering MFIs and NBFCs: The Necessity of an Enterprise Risk Management Tool

In the ever-evolving landscape of Microfinance Institutions (MFI) and Non-Banking Financial Companies (NBFCs), effective risk management is the linchpin of success and sustainability. MFIs and NBFCs encounter diverse risks, ranging from strategic and operational risks to regulatory compliance, reputational, financial, environmental, and political risks. To navigate these complexities and ensure long-term growth, a robust Enterprise Risk Management (ERM) tool is essential. Let’s delve into the significance of an ERM tool and how it aids in grading risks and guiding institutions from higher risk to lower risks by tracking unit-level risk scores.

The Need for an Enterprise Risk Management Tool:

Comprehensive Risk Identification: MFIs and NBFCs face a myriad of risks in their operations, from potential strategic missteps to operational inefficiencies and compliance challenges. An ERM tool enables organizations to comprehensively identify and assess risks across all dimensions, providing a holistic view of potential threats.

Proactive Risk Mitigation: To thrive in a competitive market, organizations must proactively address risks before they escalate. An ERM tool facilitates early detection of risks, allowing swift and targeted mitigation strategies, ensuring smooth operations and safeguarding reputation.

Regulatory Compliance: The financial landscape is heavily regulated, and non-compliance can lead to severe consequences. An ERM tool aids MFIs and NBFCs in tracking and adhering to ever-changing regulatory requirements, ensuring compliance at all levels of the organization.

Preserving Reputation: Reputational risk is a significant concern for financial institutions. A single negative event can have a lasting impact on customer trust and brand reputation. An ERM tool helps in identifying potential reputational risks and deploying measures to protect the organization’s image.

Leveraging Arukus Technologies ERM Tool for Risk Grading and Mitigation:

Risk Grading and Scoring: Arukus Technologies ERM tool provides a systematic framework for grading risks based on their potential impact and likelihood of occurrence. Assigning risk scores allows organizations to prioritize and allocate resources to address the most critical risks effectively.

Tracking Unit-Level Risk Scores: MFIs and NBFCs consist of multiple units or departments, each having distinct risk exposures. An ERM tool enables tracking and monitoring unit-level risk scores, allowing targeted risk management strategies for each department.

Risk Mitigation Strategies: Armed with real-time data and insights, organizations can devise tailored risk mitigation strategies. The ERM tool aids in implementing controls and preventive measures to move from higher-risk areas to lower-risk zones, bolstering overall resilience.

Data-Backed Decision Making: Informed decision-making is a hallmark of successful organizations. Arukus Technologies ERM tool equips MFIs and NBFCs with data-driven insights, enabling management to make well-informed decisions for risk reduction and organizational growth.

Arukus Technologies designed the Enterprise Risk Management tool which is proving to be a game-changer for MFIs and NBFCs by offering a proactive and holistic approach to manage risks across various domains. From strategic planning to operational efficiency, regulatory compliance, and reputational protection, the ERM tool empowers financial institutions to identify, grade, and address risks efficiently. By tracking unit-level risk scores, organizations can implement targeted risk mitigation strategies and move toward a future of minimized risk exposure, securing a path of long-term success and resilience in an increasingly dynamic financial landscape.

Copyright © 2026 All rights reserved - Arukus Technologies

Enter the 6-digit code we sent to your email id.